NHPC Ltd., India’s leading hydropower company, has emerged as a vital player in the nation’s renewable energy ecosystem. As investors and market enthusiasts project the company’s growth trajectory, the question arises: What could be the NHPC share price target in 2040? This in-depth analysis will shed light on various factors influencing NHPC’s future, its potential valuation, and insights to guide investment decisions.

Overview of NHPC’s Current Position

NHPC Ltd., a government-owned enterprise, specializes in generating clean, renewable hydropower. With an operational history spanning over 50 years, the company boasts an installed capacity exceeding 7,000 MW across India. Its consistent financial performance and robust fundamentals make NHPC a cornerstone in India’s push towards sustainable energy.

The Renewable Energy Boom

Hydropower’s Role in a Greener Future

Hydropower, a cornerstone of renewable energy, is pivotal to India’s environmental goals. With increasing focus on sustainability, NHPC is uniquely positioned to benefit from government policies promoting green energy. As a market leader, NHPC could see exponential demand growth, directly impacting its valuation by 2040.

Factors Driving NHPC’s Share Price Growth

Strong Financial Performance

NHPC has demonstrated resilience and adaptability, consistently delivering strong financial results. By maintaining operational efficiency and controlling costs, the company ensures stable returns for investors.

Government Support and Policy Boosts

India’s renewable energy initiatives, including substantial subsidies and incentives for green projects, bolster NHPC’s prospects. Hydropower’s inherent reliability and sustainability further position NHPC as a key beneficiary.

Expansion and Diversification

NHPC is actively diversifying its portfolio by exploring solar and wind energy projects, complementing its hydropower expertise. This diversification not only mitigates risks but also enhances its appeal to a broader range of investors.

NHPC Share Price Target in 2040

What Analysts Predict

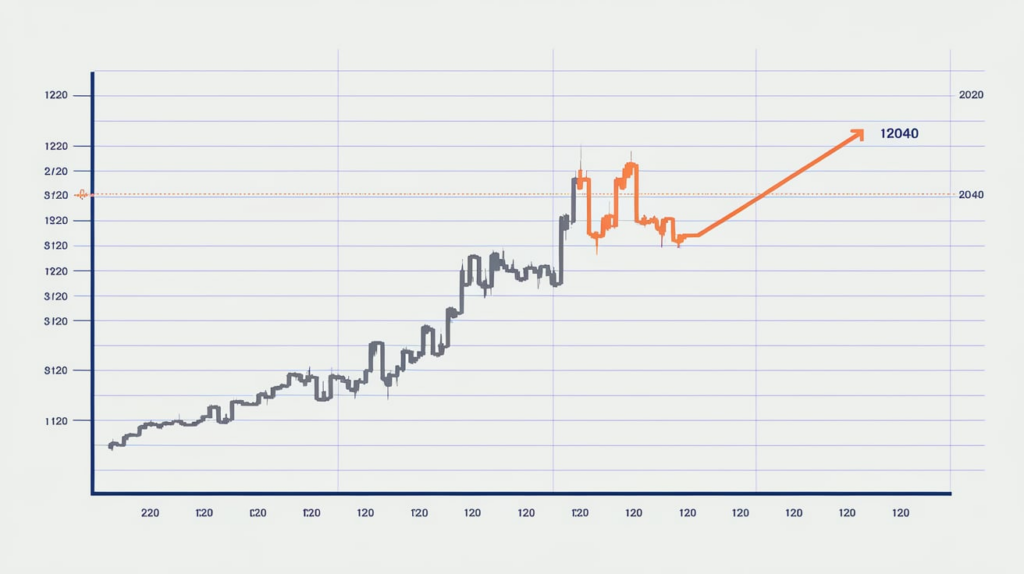

Market analysts have set varied targets for NHPC’s share price in 2040, reflecting differing perspectives on growth potential and market conditions:

- ₹117: As projected by Prabhudas Lilladher, this target factors in steady growth, operational expansion, and a favorable policy environment.

- ₹97: The median forecast, which considers consistent but moderate growth, aligns with NHPC’s historical performance trends.

These projections suggest significant growth from current levels, though actual results will depend on market dynamics, government policies, and global energy trends.

Challenges to Consider

Dependence on Regulatory Frameworks

Hydropower projects often face regulatory hurdles, including environmental clearances and land acquisition issues. Any unfavorable changes in government policies could impact growth.

Competition in Renewable Energy

As India diversifies its renewable energy sources, NHPC may face competition from solar and wind energy firms. Its ability to innovate and adapt will determine its competitive edge.

Climate Risks

Hydropower is climate-dependent, and changing weather patterns could influence project efficiency and profitability.

Is NHPC a Good Long-Term Investment?

NHPC stands out for its solid fundamentals, government backing, and alignment with India’s renewable energy goals. Its commitment to sustainability and operational excellence makes it a promising long-term investment. However, potential investors should consider the associated risks and conduct thorough research or seek professional advice before making decisions.

Also Read:Vikas Lifecare Share Price Target 2030

Conclusion: A Promising Future with Caveats

The NHPC share price target for 2040 reflects the company’s growth potential in a rapidly evolving renewable energy landscape. With favorable government policies, strategic diversification, and a commitment to sustainability, NHPC is well-positioned for long-term success. However, investors must remain vigilant about external challenges and market fluctuations.

If you’re considering NHPC as part of your portfolio, ensure your decisions align with your financial goals and risk appetite. The journey to 2040 promises to be as dynamic as the energy sector itself.

One thought on “NHPC Share Price Target 2040: A Comprehensive Analysis”