The Digital World Acquisition Corp. (DWAC) stock has become a hot topic among investors, thanks in part to its planned merger with Trump Media & Technology Group, which operates the social media platform Truth Social. For those following DWAC stock, there are several factors influencing its forecast, each bringing unique challenges and opportunities. Below, we’ll break down the elements driving DWAC’s stock performance and provide an in-depth look at what investors might expect moving forward.

DWAC Stock and SPAC Volatility

DWAC is a Special Purpose Acquisition Company (SPAC), designed specifically for merging with an existing company—in this case, Trump Media & Technology Group. SPACs typically experience high volatility, and DWAC is no exception. Here are some reasons why:

- Market Sensitivity to News

- DWAC stock often responds dramatically to news events, particularly those related to its prospective merger. Political developments, media coverage, or regulatory updates can all influence the stock price, making DWAC a particularly news-sensitive investment.

- Unpredictable Short-Term Price Fluctuations

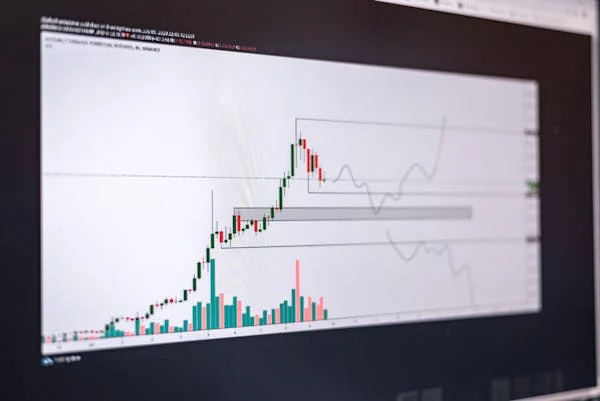

- Short-term DWAC stock predictions are difficult due to its volatile nature. Recent price movements suggest that the stock responds sharply to political headlines and regulatory discussions, meaning sudden rises or falls in DWAC’s price are likely to continue.

Regulatory Hurdles Facing DWAC

One of the critical factors affecting DWAC’s future is its regulatory status. The SEC has conducted investigations related to DWAC’s merger plans, scrutinizing aspects of its partnership with Trump Media & Technology Group. For investors, this regulatory scrutiny introduces two main issues:

- Uncertain Merger Timeline

- Regulatory delays can affect when, or even if, DWAC finalizes its merger with Trump Media. This uncertainty is a substantial consideration for investors, as it directly influences the timeline for DWAC’s growth.

- Potential Legal Implications

- Should the SEC or other regulatory bodies introduce conditions or sanctions, DWAC’s future could face significant hurdles. Investors should weigh these regulatory risks against the potential for long-term gains.

The Role of Market Sentiment in DWAC’s Performance

DWAC’s performance is not only influenced by internal developments but also by broader market trends and public sentiment toward technology and SPAC stocks. A few noteworthy factors include:

- SPAC Market Trends

- SPACs gained substantial popularity in recent years, yet the overall market has seen a shift as regulators impose stricter guidelines on these investment vehicles. This industry trend can impact DWAC, as SPACs are now subject to higher scrutiny.

- Technology Sector Sentiment

- DWAC is categorized under technology investments due to its association with Trump Media & Technology Group. Trends in tech stocks and social media platforms can affect DWAC’s attractiveness, especially as investor interest in technology and social platforms fluctuates.

Potential Long-Term Outlook for DWAC Stock

Despite the volatility and regulatory challenges, there are reasons for optimism. If DWAC successfully completes its merger and Truth Social gains widespread adoption, the stock could experience substantial long-term growth.

- Increased Platform Engagement

- Truth Social, if it succeeds in building a large, active user base, could positively impact DWAC’s stock value. Growing engagement on Truth Social could translate into higher ad revenue and more significant investor confidence.

- Potential Profitability

- For DWAC, profitability is crucial. Should Truth Social demonstrate a profitable business model, this would likely increase investor trust, helping DWAC achieve a more stable valuation.

Risks to Consider Before Investing in DWAC

While DWAC offers upside potential, investors should be mindful of the risks, particularly with SPAC investments. Key risks include:

- Dilution of Share Value

- SPAC structures sometimes lead to shareholder dilution, which can reduce the stock’s per-share value. Investors should understand the dilution risk, particularly if DWAC issues more shares in the future.

- Political and Social Media Landscape

- Truth Social operates within a politically sensitive environment. Public sentiment towards the platform could affect its adoption rates, influencing DWAC’s profitability and long-term value.

- Market Conditions

- Broad economic trends can also impact DWAC, particularly if market downturns occur. A decline in tech stocks or rising interest rates could affect the broader SPAC market, thereby impacting DWAC.

Where to Find Up-to-Date DWAC Information

For those tracking DWAC stock closely, it’s essential to consult reputable sources regularly:

- Financial News Sites

- Websites like Bloomberg, MarketWatch, and Reuters provide timely updates on stock performance, regulatory developments, and market trends. These platforms offer essential information that can help investors make informed decisions.

- Stock Market Platforms

- Websites like Yahoo Finance, Google Finance, and TradingView provide DWAC’s real-time price movements and historical performance. These platforms offer insights for those assessing DWAC’s forecasted growth.

- Social Media and Discussion Platforms

- Platforms like Twitter and Reddit feature active discussions about DWAC, where investors can share insights and updates. While these discussions are helpful, it’s essential to verify information from reliable sources.

Final Thoughts on DWAC Stock Forecast

DWAC is a complex investment due to its volatility, regulatory uncertainties, and reliance on Truth Social’s success. While DWAC offers potential long-term gains if its merger with Trump Media & Technology Group is finalized, short-term risks and potential regulatory hurdles remain. For investors, keeping a balanced perspective and staying informed are key. Before investing, conducting thorough research or consulting a financial advisor can provide clarity on whether DWAC aligns with one’s investment goals and risk tolerance.

Also Read:Honda Grom: A Year-over-Year (YOY) Growth Story in Compact Motorcycling

One thought on “DWAC Stock Forecast: What’s Next for Digital World Acquisition Corp.?”