The Indian stock market has been buzzing with activity, and Larsen & Toubro (L&T) is often in the spotlight due to its strong fundamentals and diverse business portfolio. If you’re curious about the L&T share price target for 2025, let’s dive into an engaging review to understand what might drive its performance and what analysts are forecasting.

What Influences L&T’s Share Price?

Larsen & Toubro’s stock performance hinges on multiple factors. Here are the key drivers that shape its trajectory:

Diversified Business Portfolio

L&T operates in core industries like engineering, construction, technology, and financial services. This diversification reduces risks and provides stability during market fluctuations.

Government Infrastructure Push

India’s focus on infrastructure development, including roads, highways, and renewable energy projects, bodes well for L&T, as it secures major contracts in these sectors.

Global Expansion

The company’s growing presence in international markets strengthens its revenue streams, helping it withstand domestic market volatility.

Financial Performance

Steady revenue growth, healthy profit margins, and a strong balance sheet make L&T a reliable pick for long-term investors.

Market Sentiment

Investor confidence and overall stock market trends significantly impact the share price. Positive earnings reports and major project wins typically lead to bullish sentiment.

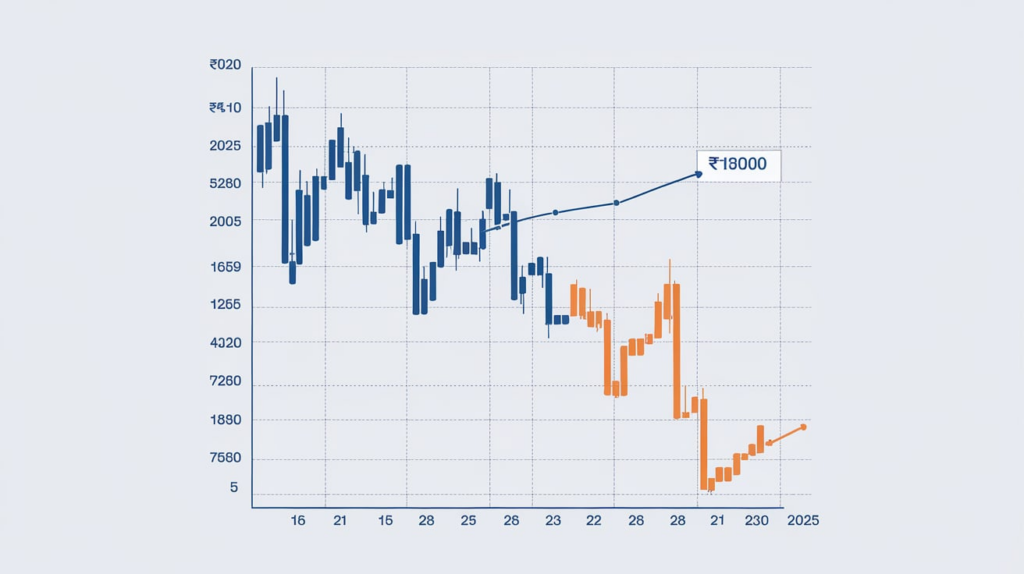

Expert Predictions for 2025

Bullish Scenario

Analysts optimistic about L&T’s future suggest that the stock could see substantial growth by 2025. A booming infrastructure sector and sustained order inflows could propel the stock to new highs. Under this scenario, some estimates suggest a share price target of ₹2,500–₹3,000.

Moderate Growth Scenario

In a more conservative outlook, L&T’s share price might rise steadily, reflecting its historical performance. Analysts forecast a target of around ₹2,000–₹2,200 under this scenario.

Bearish Risks

Unforeseen risks, such as economic slowdowns or regulatory hurdles, could temper growth. While unlikely, such events might keep the stock closer to ₹1,800.

Key Metrics to Watch

Order Book Growth

A robust order book signals future revenue. Keep an eye on the contracts L&T secures in India and abroad.

Earnings per Share (EPS)

EPS is a critical indicator of profitability. Rising EPS suggests the company is creating more value for shareholders.

Debt Levels

While L&T’s debt is manageable, a sudden spike could affect investor sentiment. Balanced debt-to-equity ratios are key to maintaining trust.

Sectoral Trends

Construction, engineering, and technology industries often mirror L&T’s performance. Track these sectors for insights.

Should You Invest?

Pros

- Strong Fundamentals: L&T’s diversified portfolio and financial stability make it a reliable choice.

- Growth Potential: The infrastructure boom in India is likely to benefit the company.

- Dividend History: Regular dividends add to its appeal for long-term investors.

Cons

- Market Volatility: Economic changes can impact short-term performance.

- High Expectations: While the company is robust, high valuations might limit upside potential.

Also Read:Understanding Candlestick Patterns PDF

Conclusion: L&T Share Price Target for 2025

Larsen & Toubro is well-positioned to leverage its strengths in engineering, construction, and financial services to deliver strong results. While predictions vary, the L&T share price target for 2025 largely points toward growth, with optimistic forecasts reaching ₹3,000.

Investors should conduct thorough research, monitor market trends, and consult financial advisors before making decisions. With a balanced approach, L&T could be a cornerstone of a successful investment strategy in the coming years.

By staying informed and proactive, you can make the most of L&T’s growth journey in the years ahead!

One thought on “L&T Share Price Target 2025: What to Expect?”